www.ftb.ca.gove/pay : Franchise Tax Board Homepage | FTB.ca.gov Payment

In January 2022, the Franchise Tax Board (FTB) began an outreach effort by sending Schedule A review letters. FTB will continue the outreach effort by sending review letters in May to taxpayers who reported large Schedule A itemized deductions on their 2019 tax returns that are “significantly higher than expected.”

The purpose of the review letter is to encourage taxpayers to review their 2019 tax return, and current tax years, for any discrepancies.

www.ftb.ca.gove/pay :

The California Middle Class Tax Refund Card (“MCTR Card”) is a prepaid debit card distributed to qualified recipients that contains the Middle Class Tax Refund (“MCTR”) payment, a one-time payment to provide relief to qualified Californian personal income tax filers.

You are eligible if you:

- Filed your 2020 tax return by October 15, 2021;

- However, if you applied for an Individual Taxpayer Identification Number (ITIN) but did not receive it by October 15, 2021, you must have filed your complete 2020 tax return on or before February 15, 2022.

- Meet the California adjusted gross income (CA AGI) limits;

- Were a California resident for six months or more in the 2020 tax year;

- Were not eligible to be claimed as a dependent in the 2020 tax year; and

- Are a California resident on the date this payment is issued.

To learn more about the Middle Class Tax Refund payment amounts and to estimate your payment, visit ftb.ca.gov/MyEstimate.

How will I receive my payment?

If you qualify, you will receive either a direct deposit payment to your bank account or a payment by the MCTR prepaid debit card. You will receive your payment by direct deposit if you filed your 2020 return electronically and indicated direct deposit for your tax refund. Otherwise, you will receive your payment by MCTR prepaid debit card. Taxpayers receiving payment by the MCTR prepaid debit card include:

- Taxpayers who filed a paper return.

- Taxpayers who received their tax refund by check regardless of filing method.

- Taxpayers who had a balance due for their 2020 tax return.

- Taxpayers who received their Golden State Stimulus I and/or II payment(s) by check.

- Taxpayers who received an advanced refund from their tax service provider, or paid their tax preparer fees using their tax refund.

When will I receive my MCTR Card?

mctrpayment com Login Activate Card :

If you have received a MCTR Card and want to activate it, call 1-800-240-0223. For cards that have two names embossed, the cardholder shown first must call to activate the card.

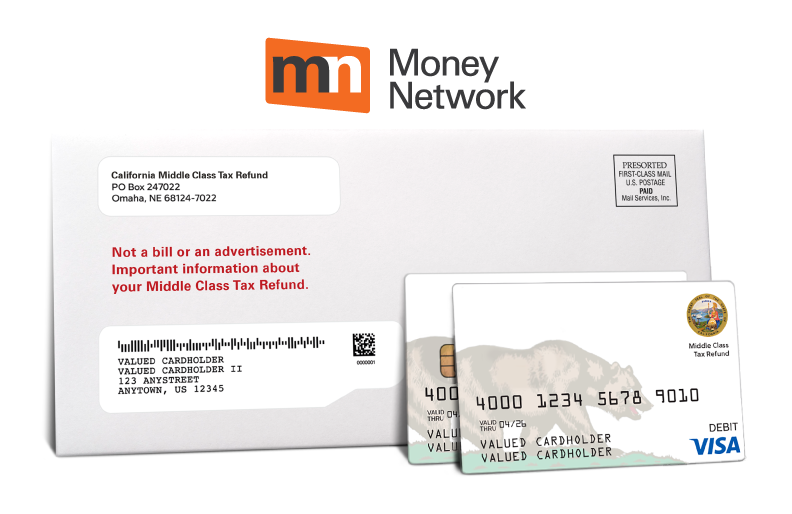

Your MCTR Card will arrive in a white envelope that prominently displays the California state seal and includes “California Middle Class Tax Refund” in the return address. The envelope also states that it is “Not a bill or advertisement.

Important information about your Middle Class Tax Refund.” The Visa® name will appear on the front of the Card; the back of the Card has the name of the issuing bank, My Banking Direct, a service of New York Community Bank. Information included with the Card will explain that the Card is your Middle Class Tax Refund Debit Card.

How can I get cash using my MCTR Card?

- Cash from an ATM:

- There’s no fee to withdraw cash at in-network ATMs that carry the Allpoint or MoneyPass® brands, but fees may apply if you use an out-of-network ATM. To find surcharge-free in-network ATMs, use our ATM Locator found at mctrpayment.com or in the Money Network® Mobile App.³

- To get cash at an ATM:

- Enter your 4-digit PIN

- Select “Withdrawal” from “Checking”

- There’s no fee to withdraw cash at in-network ATMs that carry the Allpoint or MoneyPass® brands, but fees may apply if you use an out-of-network ATM. To find surcharge-free in-network ATMs, use our ATM Locator found at mctrpayment.com or in the Money Network® Mobile App.³

ATM Withdrawal Limits Apply: $600 per transaction (ATM operator limits may be lower). Please see your Cardholder Agreement and Fee Schedule online at

- for more information.

- Cash-back from participating merchants:

A convenient way to get cash back with your Card is at the places you already shop, like grocery and convenience stores.- To request cash-back from a merchant:

- Select “Debit” on the keypad

- Enter your 4-digit PIN

- Select “Yes” for cash-back

- Enter the amount and hit “OK”

Availability, limits, and fees² may vary based on merchant practice. Please see your Cardholder Agreement and Fee Schedule online at mctrpayment.com for more information.

- To request cash-back from a merchant:

- Cash from a bank or credit union teller:

You can visit any bank or credit union branch that features a Visa logo to withdraw cash for a fee².- To withdraw cash at a bank:

- Know your balance beforehand – the teller cannot tell how much money you have on your Card

- Ask the teller for the amount you would like to withdraw

- You will need your 4-digit PIN and may be asked for an additional form of ID

Bank/Teller Over-the-Counter Withdrawal Limits Apply: $600 per transaction (bank limit may be lower). Please see your Cardholder Agreement and Fee Schedule online at mctrpayment.com for more information.

- To withdraw cash at a bank:

Be the first to comment