tbom/fortiva Credit Report : What is TBOM Fortiva on a Credit Report?

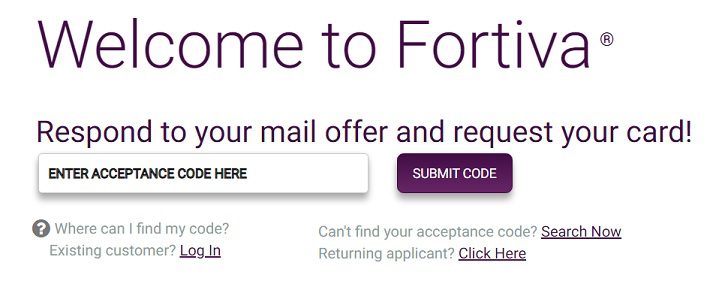

“TBOM Fortiva” on a credit report indicates that you have a credit account, most likely a credit card, issued by The Bank of Missouri (TBOM) under their Fortiva program.

- TBOM stands for The Bank of Missouri. They are the financial institution actually providing the credit.

- Fortiva is a brand name used by TBOM for a credit card program targeted towards individuals who might have less-than-perfect credit.

If you see this on your credit report, it means you’ve been approved for and are using a Fortiva credit card. This account will impact your credit score based on how you manage it – paying on time, keeping your balance low, etc.

How it will Impact the Score

The impact of the TBOM Fortiva credit card on your credit score will depend entirely on how you manage it. Like any other credit account, it has the potential to both help and hurt your score.

Also Read : www.jcpenney.com/survey

Positive Impacts:

- Builds Credit History: If you’re new to credit or rebuilding, responsible use of this card (paying on time, keeping utilization low) can significantly improve your score over time.

- Credit Mix: Having different types of credit (e.g., revolving credit like a credit card alongside installment loans) can also positively contribute to your score.

- Increased Credit Limit: Over time, if you use the card responsibly, you may be offered credit limit increases, which can further improve your score by lowering your overall credit utilization ratio.

Negative Impacts:

- High Interest Rates & Fees: Fortiva cards often come with higher interest rates and fees. If you carry a balance, interest charges can accumulate quickly, making it difficult to pay off the card and potentially leading to missed payments.

- Missed or Late Payments: Any missed or late payments will be reported to the credit bureaus and can significantly damage your credit score.

- High Credit Utilization: If you use a large portion of your available credit (high credit utilization), it can negatively impact your score.

In conclusion:

- Responsible use: If you use the TBOM Fortiva card responsibly by making on-time payments, keeping your balance low, and avoiding maxing out the card, it can be a helpful tool for building or rebuilding your credit.

- Irresponsible use: However, if you miss payments, carry high balances, or otherwise mismanage the card, it can severely damage your credit score.

It’s crucial to understand the terms and conditions of the card, including interest rates and fees, and to create a budget to ensure you can make timely payments each month.