Mercury Credit Card Login : www.mercurycards.com Login and Activate Card

If you receive your MasterCard from Mercury, you need to activate your card to properly use it. You simply have to follow some steps to activate your card quickly. You are also required to login to your account to perform several kinds of functions on this card.

- Visit the Mercury Credit Card website at https://www.mercurycards.com/mercurycard/.

- Click on the Login link at the top of the page.

- Enter your username and password in the fields provided.

- Click on the Login button

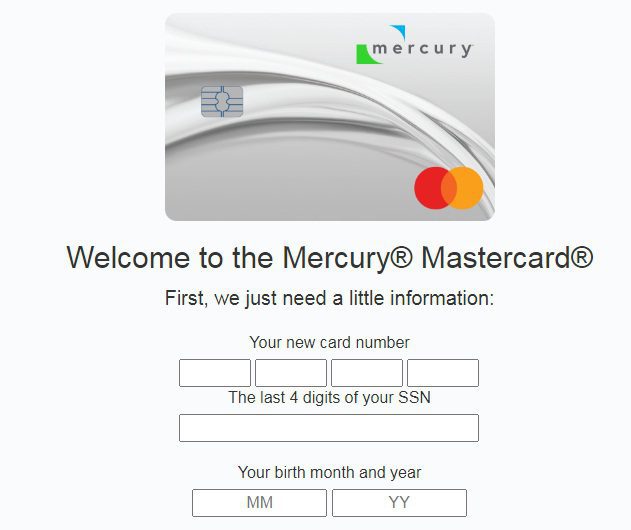

How to Activate your Mercury MasterCard

1. A Mercury MasterCard credit card can be activated online.

2. You need a basic connection to the Internet.

3. Simply open www.mercurycards.com’s official website/activate to start the process.

4. Make sure you have in your hand your card number.

To obtain a Mastercard for mercury, you must be 18 years old or older and you must also be a legal resident of the United States

You are asked to open www.mercurycards.com/mercurycard if you are willing to apply for a card, then you have to click on the answer to your mail offer

You have to have a card number and the last 4 digits of SSN and you have to ensure you have the date of birth, if you want to activate your card.

Connect to an external bank account

You can link other bank accounts to your Mercury accounts for easier transfers and money management.

Here’s how to do it:

- Log in to your Mercury dashboard.

- Click the blue Move Money button in the upper right corner, then select Transfer Between Accounts.

- Click on the Transfer From dropdown, then scroll to the bottom and click Link a Bank Account.

- Using the Plaid pop-up, find your bank and enter your credentials when prompted. If your bank is not selectable from the Plaid dropdown, we’re currently unable to support a connection.

The account should now be linked. You can find account info, manage the connection, and initiate new transfers by going to Accounts from your left sidebar menu, then clicking the Linked Accounts tab.

If you receive an error when trying to log in, double check that you’re using the correct login, password, and login method. It can be also be helpful to log in to your bank directly and make sure there are no error messages or items you need to action before connecting.

What is my Annual Percentage Rate (APR)?

If you are an existing customer, your APR (Annual Percentage Rate) was included in the Pricing Schedule, which is part of your Cardmember Agreement. Your APR can also be found on your monthly billing statement.

When is interest charged?

You will not be charged interest on purchases in a billing period in which you pay the new balance in full by the payment due date. If you do not pay your new balance in full by the due date in a billing period, we charge interest on all new and existing purchases for that billing period. For balance transfers and cash advances, we charge interest from the transaction date until you pay the total amount you owe.

How much do I have to pay each month?

Each billing period you must pay at least the minimum payment due by the payment due date shown on your billing statement. If you don’t pay at least the minimum payment due by the payment due date or have a returned payment, a late fee or returned payment fee may be charged to your account. You can pay more at any time. See your Cardmember Agreement for more details.

In which countries is my card not permitted to be used?

Your card cannot be used to conduct transactions in any country or territory, or with any individual or entity that is subject to economic sanctions administered and enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC).