How To Activate Lloyds Debit Card Online

When using your Lloyds debit card for the first time, you don’t need to activate it by online. If you have a contactless card, you will need to use your PIN for your first transaction. You can do this when making a payment in a shop or using a Cashpoint®.

To activate your Lloyds debit card, you have a few options:

Online Activation:

- Log in to your Lloyds online banking account.

- Navigate to the card section.

- Follow the prompts to activate your debit card.

Phone Activation:

- Call Lloyds customer support using the number provided on their website.

- Follow the instructions to activate your card over the phone.

ATM Activation:

- Use your debit card and security number at a nearby ATM.

- This will automatically activate your debit card.

Remember, once activated, you can use your Lloyds debit card for online purchases, in-store transactions, and cash withdrawals. Happy banking!

Once you’ve done that, all future transactions can be contactless. For added security, every now and again you might be asked to enter your PIN.

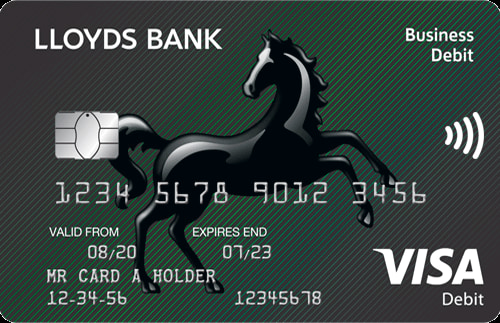

What is a debit card?

Your debit card allows you to spend online and in shops for all sorts of goods and services, and takes the payment directly from your bank account. You’ll get one with most Lloyds Bank current accounts.

With a debit card, you can:

- book or buy online, in shops, or over the phone

- take out money from any Cashpoint® in the UK, or cash machines around the world.

- use your card worldwide, whenever you see the Visa symbol.

- make contactless payments with your debit card or even using Apple Pay or Google Pay up to the value of £100.

- Buy things online in just a few clicks with Visa Click to Pay

- spend safely with Visa Chargeback protection against fraud or issues with goods bought from retailers.

Reporting a lost or stolen debit card

- If your debit card is lost or stolen, you can report it to us and request a new card by logging onto Internet Banking or in our Mobile Banking app

- You can also call us on 0800 096 9779 (lines open 24hrs a day, 7 days a week) or +44 1702 278 270 (outside the UK)

- While you wait for your new card to arrive, you can view your card details in the Mobile Banking app. These should be available the day after requesting a replacement

- You can also freeze and unfreeze your card which could be useful if you’ve temporarily forgotten where you put your card

Problems with your card

- You can see a reminder of your PIN in our Mobile Banking app in case you have forgotten it

- If your card is declined and you’re concerned, you have unrecognised transactions, or you need to request a new PIN, call us on 0345 300 0000 (lines open 8am – 8pm, seven days a week. Not all Telephone Banking services are available 24 hours a day, seven days a week.) or +44 1733 347 007 (outside the UK)

- You can also order replacement cards and PINs by logging onto Internet Banking or in our Mobile Banking app

Your debit card is the easy way to pay for most things, all over the UK.

- Use for everyday shopping or big purchases

- Shop in-store, online or over the phone

- Pay bills easily, whether they’re one-off or regular

- Withdraw cash at Lloyds Bank Cashpoint machines or other cash machines

- Skip the cash machine queues – get up to £100 cashback at most supermarkets

The amount you can withdraw at a Cashpoint or other cash machines is £800 per day if you hold a Lloyds Bank debit card.

Use your Visa debit card for shopping and cash withdrawals abroad, just as you do at home, wherever you see the Visa symbol. There are fees for using your debit card abroad.

Just a few reasons for using your debit card abroad:

- Accepted all over the world

- No need to carry large amounts of cash

- Get an automatic record of the transaction

- Protection against fraud for any unauthorised spending

- Shop online in any currency (although fees apply)

You can use your debit card to withdraw money at a cash machine or over the counter at any bank displaying the Visa symbol. You can withdraw money up to your limit in pounds as long as you have cleared available funds in your account. You’ll need to know your PIN and have some ID (a valid passport will do) when you withdraw money from a bank.