Capital One Your Account Details Were Last Updated: Activate New Capital One Card

You’ll notice that your previous Capital One account appears as “closed” online. Your account has been converted and it simply has a new name. There’s nothing to do on your part; the original number on this account hasn’t changed.

Your statements will include your account’s entire transaction history. To view previous statements, just click on any bank account tile and select “view statements.” Transactions from before your conversion date can also be viewed by clicking on the closed account tile, which will be available for three months after your account’s conversion.

Why did my account change?

Over the past decade, we’ve merged with several banks, so this change is an effort to consolidate our products and provide you with a more cohesive banking experience.

Should I start using the new routing number?

You will see a new routing number (031176110) associated with your account. Most transactions using the former routing number will still be processed – so you won’t need to make any changes to previous transactions you’ve set up, like direct deposits. However, we advise that you use the new routing number for incoming wire transfers or international ACH deposits, including international direct deposits, to avoid any delays in posting.

You may notice a change in the way deposits post to your new account. Any external deposit (e.g., direct deposits, transfers coming from another bank), which may have previously posted on a weekend or bank holiday, will now post by 8 a.m. ET the next business day. Business days are Mondays through Fridays, excluding federal holidays.

What about my paperless settings?

If you chose to receive paper communications for one or more of your accounts prior to conversion, all of your accounts will be switched to paper communications. To re-enroll, follow these simple steps:

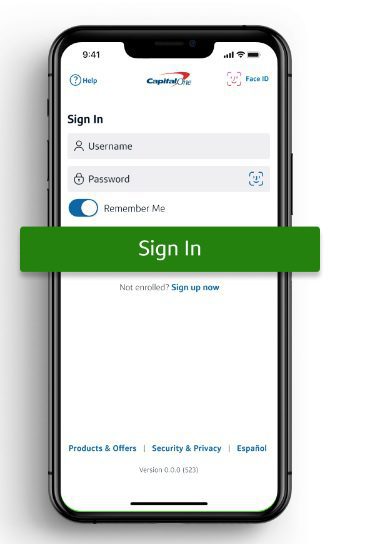

- Sign in at capitalone.com.

- Click “view account” on your open account tile.

- Click “account services & settings.”

- Click “paperless.”

- Click “go paperless for theseaAccounts.”

- Click “done.”

Keep in mind that choosing paperless settings will apply to all your new accounts.

Just follow the directions under Consolidate Your Accounts. Once you’ve linked your credit card accounts, you can activate your new card.

Once your new card is in hand, activation takes just minutes @ activate.capitalone.com.

If you apply New Capital One by phone or online, you will often get a response in 60 seconds. However, in some cases we need to collect additional information to make a decision

If you’re approved, you should receive your Capital One card, credit limit information, and welcome materials by mail within approximately 7 to 10 business days. However, customers approved for a Secured Mastercard card will need to pay the deposit in full before the card ships—then it should be approximately 7 to 10 business days.

capitalone.com Activate My Card Online:

Activate your card as soon as it arrives, and you can start enjoying all it has to offer

- Sign in to your account (capitalone.com login)—online or on the Capital One Mobile app. (Text “MOBILE” to 80101 for a link to download).

- Choose the account linked to your debit card.

- Look for a button to activate your card (capitalone.com activate card) next to the debit card delivery tracker online, or below your account balance in the mobile app.

- Select “Activate Your Card” and follow the steps shown. You may be asked to set a PIN to complete the activation process

Can I lock my debit card?

Yes, you can—anytime, anywhere.

Locking your debit card will prevent transactions until you unlock it. Keep in mind that this won’t prevent automatic bill payments or other scheduled transfers from occurring.

- Sign in to your account—online or on the Capital One Mobile app. (Text “MOBILE” to 80101 for a link to download).

- Select the account linked to your debit card

On the web: Choose “Account Services and Settings.”

• Under “Manage Debit Card”, choose “Lock Your Card” and follow the steps.

On the app: Select “Lock Card” from the “I Want To…” menu.

The Prime Rate is a benchmark interest rate used by Capital One and most other banks to set rates on consumer loan products, such as credit cards. The Prime Rate is based upon, and generally changes with, the Federal Reserve’s Fed Funds Rate. You can find the current Prime Rate in the money rates column of The Wall Street Journal. If your credit card or any other loan has a variable APR based on the Prime Rate, whenever the Prime Rate changes, the variable APR on your account will likely change with it.

To find the current APR for your account, check the “Interest Charge Calculation” section of your monthly credit card statement, either online or on the statement you receive in the mail.

Doing the following can help you minimize interest charges:

- If possible, pay your balance in full to avoid interest charges.

- Making on-time payments of more than your minimum payment each month will reduce the overall amount of interest you pay.