Canada Life Group Benefits Login : mycanadalife@work.com Login

If you’re looking to manage your Canada Life group benefits, here are a few options:

- Workplace Benefits and Savings Plans:

- Sign in to My Canada Life at Work to manage your workplace benefits and savings.

- This includes group retirement, savings, and other workplace benefits.

- Personal Investments and Insurance:

- Access your personal investments, savings, and insurance all in one place through My Canada Life at Work.

- If you bought these through an advisor, you can also manage them there.

- Other Canada Life Sites:

- Freedom to Choose™ Health and Dental Insurance : Access your personal benefits and dental insurance.

- Creditor Portal: Manage your creditor insurance account and claim history.

- Constellation Managed Portfolios : Track your investments and goal progress.

- VIP Net : Access your Canada Life Generations policy, group retirement, savings, and more.

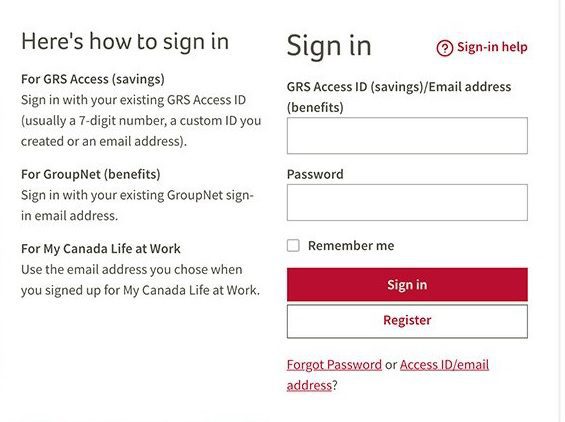

If you’re an employer administering group benefits and savings plans, sign in to GroupNet or GRS for employee information, billing statements, and reports.

What are the benefits of Canada Life group plans?

Canada Life group plans offer several benefits for both employers and employees. Here are some key advantages:

- Comprehensive Coverage:

- Group plans typically provide comprehensive coverage for health, dental, vision, and other benefits.

- Employees can access services they might not otherwise afford individually.

- Cost Savings:

- Group plans allow employers to negotiate better rates with insurers due to the collective buying power of the group.

- Employees benefit from lower premiums compared to individual plans.

- Tax Efficiency:

- Premiums paid by employers are often tax-deductible, reducing the overall cost.

- Employees may also receive tax benefits on their contributions.

- Employee Retention and Satisfaction:

- Offering group benefits can enhance employee satisfaction and loyalty.

- It’s a valuable perk that attracts and retains talent.

- Health and Wellness Programs:

- Many group plans include wellness initiatives, such as fitness programs, mental health support, and preventive care.

- These programs promote employee well-being and productivity.

- Disability and Life Insurance:

- Group plans often include disability and life insurance coverage.

- This provides financial security for employees and their families.

Remember that specific benefits may vary based on the plan details and employer preferences.

What is the process for adding dependents to a group plan?

Adding dependents to a group benefits plan typically involves the following steps:

- Eligibility Check:

- Confirm whether your dependents (such as spouse, children, or other eligible family members) meet the plan’s eligibility criteria.

- Eligibility may vary based on factors like age, relationship, and dependency status.

- Documentation:

- Gather necessary documents, such as birth certificates, marriage certificates, or adoption papers.

- You’ll need these to prove the dependent’s relationship to you.

- Notify Your Employer or Insurer:

- Inform your employer or the insurance provider about your intention to add dependents.

- They will guide you through the process and provide any required forms.

- Complete Enrollment Forms:

- Fill out the enrollment forms accurately.

- Include details about each dependent, such as their full name, date of birth, and relationship to you.

- Submit Forms and Documentation:

- Submit the completed forms along with the necessary documentation.

- Follow the submission instructions provided by your employer or insurer.

- Effective Date:

- The effective date for adding dependents depends on the plan rules.

- It could be immediate or coincide with the next enrollment period.

- Review Confirmation:

- Once processed, review the confirmation or updated benefits statement.

- Ensure that all dependents are listed correctly.

Remember to consult your specific group benefits plan or contact your HR department for precise instructions tailored to your situation. 😊