Apple introduces Apple Pay Later : How to set up Apple Pay Later

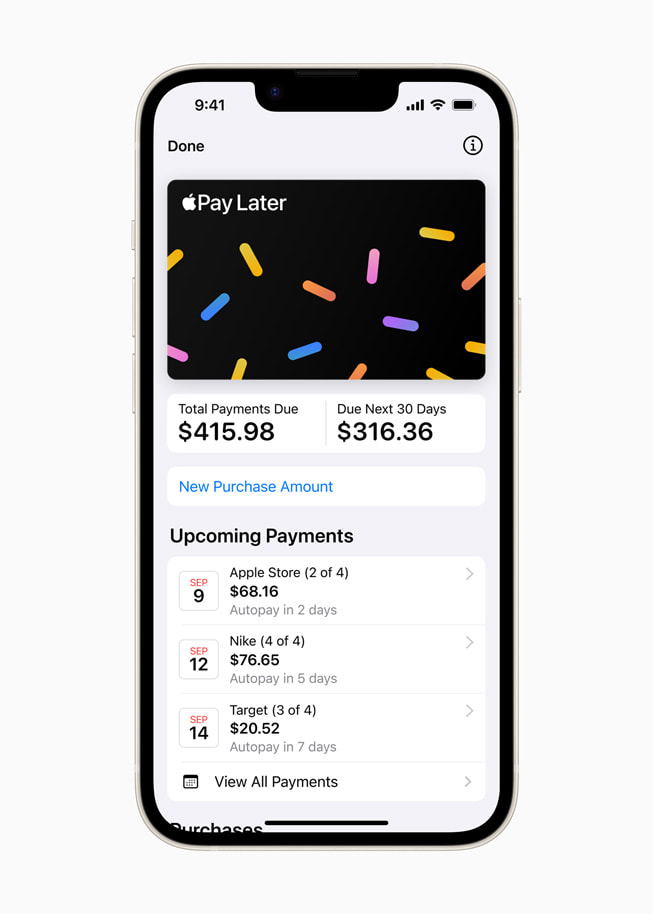

Apple today introduced Apple Pay Later in the U.S. Designed with users’ financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees. Users can easily track, manage, and repay their Apple Pay Later loans in one convenient location in Apple Wallet.

Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay. Starting today, Apple will begin inviting select users to access a prerelease version of Apple Pay Later, with plans to offer it to all eligible users in the coming months.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Apply for, Track, and Manage Loans Seamlessly in Wallet

To get started with Apple Pay Later, users can apply for a loan within Wallet with no impact to their credit.4 They will then be prompted to enter the amount they would like to borrow and agree to the Apple Pay Later terms. A soft credit pull will be done during the application process to help ensure the user is in a good financial position before taking on the loan.

After a user is approved, they will see the Pay Later option when they select Apple Pay at checkout online and in apps on iPhone and iPad, and can use Apple Pay Later to make a purchase. Once Apple Pay Later is set up, users can also apply for a loan directly in the checkout flow when making a purchase.

How to set up Apple Pay Later

Apple Pay Later is available for purchases between $50 and $1,000 made on iPhone and iPad devices that support Apple Pay. There’s no impact to your credit when you apply for an Apple Pay Later loan, and you’ll know if you’re approved in seconds.

What you need

- Be 18 years of age or older.

- Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that’s not a P.O. Box.5

- Set up Apple Pay with an eligible debit card on your device. You can only make Apple Pay Later down payments using a debit card.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS or iPadOS.

- You might need to verify your identity with a Driver License or State-issued photo ID.

Set up in Apple Wallet

Add Apple Pay Later to your Apple Wallet to get started with your first application:

- On your iPhone, open the Wallet app. On your iPad, go to Settings and tap Wallet & Apple Pay.

- Tap Add

.

. - Tap Set up Apple Pay Later, then tap Continue.

- Follow the onscreen instructions to apply for an Apple Pay Later loan. When you’re asked to input your requested amount, enter the total value of the purchase you plan to make using Apple Pay Later including estimated shipping and taxes.

- Tap Next, then verify your name, date of birth, and address.

- Review your personal information, then tap Agree & Apply.

- Review your payment plan information and loan agreement details, then tap Add to Wallet.

Apple Pay Later lets you split a purchase into four equal payments over six weeks with no interest or fees. When you use Apple Pay Later to make a purchase, we pay the merchant and you repay us for your purchase over time.

You can use Apple Pay Later at participating online and in-app merchants that accept Apple Pay.