Sofi Money Promo Bonus $50 No Deposit

If you’re interested in a SoFi bank account bonus, here’s what you need to know:

1. Eligibility: New customers who open an online SoFi Checking and Savings account qualify for the bonus.

2. Direct Deposit Requirement: To receive the full bonus, you’ll need to set up direct deposit. The bonus tiers are as follows:

- $50 bonus: For direct deposits of $1,000 to $4,999.99.

- $300 bonus: For direct deposits of $5,000 or more.

3. Additional Features: With SoFi, you’ll enjoy no account fees, no overdraft fees, and 24/7 monitoring to protect your account. Plus, you can access your paycheck up to two days early and earn up to 4.60% APY on your savings.

Ready to score that bonus? Open your SoFi account today! 😊

What are the interest rates for SoFi savings?

SoFi offers a high-yield savings account with an impressive 4.60% annual percentage yield (APY). To qualify for this rate, you can either set up a direct deposit of any amount or deposit at least $5,000 every 30 days. If you don’t meet these requirements, the APY on your savings balances will be 1.20%. Additionally, SoFi checking accounts earn 0.50% APY, and this rate applies to all customers. It’s a great way to earn more interest compared to traditional big banks! 😊

What are the fees associated with a SoFi account?

SoFi is all about keeping banking simple and fee-free! Here’s what you need to know:

- No Account Fees: SoFi Checking and Savings don’t charge any account fees. No monthly fees, no minimum balance fees, and no overdraft fees. Plus, you won’t be hit with ATM fees at 55,000+ ATMs worldwide.

- High APY: SoFi’s high-yield savings account offers an impressive 4.60% APY. To qualify, set up direct deposit or maintain a $5,000 balance.

- Early Paychecks: Get automatic 2-day early paychecks—because payday should come a little sooner.

So go ahead and bank with peace of mind! 😊

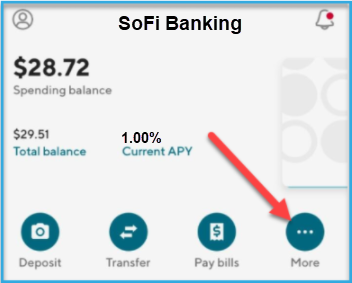

How do I open a SoFi account?

Opening a SoFi account is straightforward! Here’s how you can do it:

- Visit the SoFi Website: Go to the official SoFi website using your web browser.

- Choose Your Account Type:

- If you’re interested in both checking and savings, select the SoFi Money option.

- For just a high-yield savings account, choose SoFi Invest.

- Sign Up:

- Click on the “Sign Up” or “Get Started” button.

- Provide the required information, including your name, email address, and other details.

- Verify Your Identity:

- SoFi will ask you to verify your identity. You’ll need to provide personal information and possibly upload identification documents (such as a driver’s license or passport).

- Fund Your Account:

- To start using your account, you’ll need to fund it. You can transfer money from an existing bank account or set up direct deposit.

- Explore Features:

- Once your account is set up, explore the features like early paychecks, fee-free ATM access, and the high-yield savings account.

Remember, SoFi makes banking easy and fee-free!

Be the first to comment