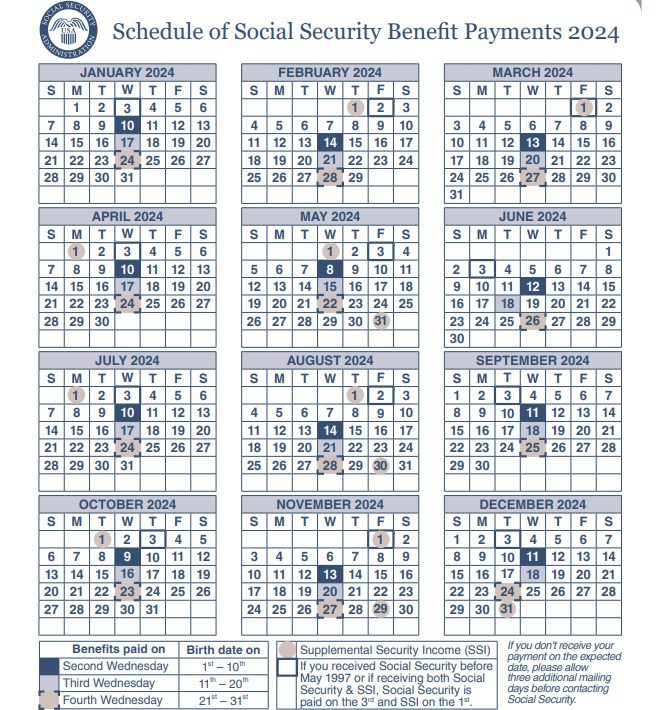

Social Security Payment Schedule 2024

Maximum Federal Supplemental Security Income (SSI) payment amounts increase with the cost-of-living increases that apply to Social Security benefits. The latest such increase, 3.2 percent, becomes effective January 2024.

Millions of United States citizens will be able to get a Social Security payment of $1800 in just a few hours if they qualify.

SSI amounts for 2024

The monthly maximum Federal amounts for 2024 are $943 for an eligible individual, $1,415 for an eligible individual with an eligible spouse, and $472 for an essential person.

In general, monthly amounts for the next year are determined by increasing the unrounded annual amounts for the current year by the COLA effective for January of the next year. The new unrounded amounts are then each divided by 12 and the resulting amounts are rounded down to the next lower multiple of $1.

Also Read : Nike Gift Card Balance Check Online

| Recipient | Unrounded annual amounts for— | Monthly amounts for 2024 | |

|---|---|---|---|

| 2023 | 2024 a | ||

| Eligible individual | $10,970.44 | $11,321.49 | $943 |

| Eligible couple | 16,453.84 | 16,980.36 | 1,415 |

| Essential person | 5,497.80 | 5,673.73 | 472 |

| a The unrounded amounts for 2024 equal the unrounded amounts for 2023 increased by 3.2 percent. | |||

Also Read : Social Security 800 Number

Payment reduction

The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses.

Countable income is the amount left over after:

- Eliminating from consideration all items that are not income; and.

- Applying all appropriate exclusions to the items that are income.

Countable income is determined on a calendar month basis. It is the amount actually subtracted from the maximum Federal benefit to determine your eligibility and to compute your monthly payment amount.

Also Read : Interim Budget 2024 Tax Relief

Social Security Benefits Increase in 2024

January 2024 marks when other changes will happen based on the increase in the national average wage index. For example, the maximum amount of earnings subject to Social Security payroll tax in 2024 will be higher. The retirement earnings test exempt amount will also change in 2024.

Be among the first to know! Sign up for or log in to your personal my Social Security account today. Choose email or text under “Message Center Preferences” to receive courtesy notifications.